B2B endures with this effective formula: articles advertising strategy + marketing. From their advertising campaigns, earned press is the most organic credible and many trickiest to make. Earned media is free. You do not ask your viewers to leave a favorable review or comment about your products or services or request that the press people... Continue Reading →

How To Write Perfect Press Releases With Steven Lewis

Many authors want to get media attention, whether it's to build reputation or attempt to sell more books. In today's interview with Steven Lewis, I find out how to write perfect press releases.

4 Ways a Press Release Service Can Help Your Public Relations

You may either send your press release directly to applicable reporters or hire a supply company that can help you land placement on a lot of sites and places. If you're looking ahead to hire a press release service, here are four ways it can help you improve your PR campaign outcomes: A distribution platform... Continue Reading →

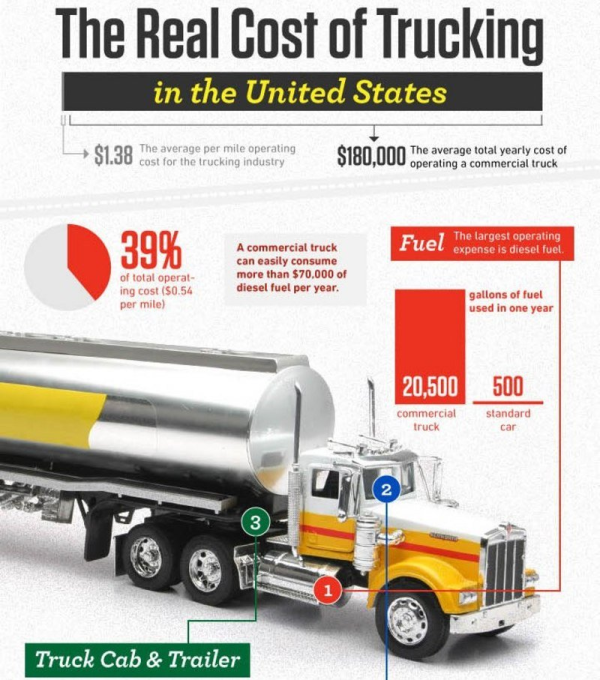

Total Cost Of Trucking In The United States

each large operator and personal owner is continuously checking information about gasoline and other different trucking operation expenses, however we don’t have the occasion to look too frequently an exact proof of what's the average expences of maintaining a truck rolling.

Start-Up Trucker | Owner Operator Truck Financing | Class 8 Truck & Trailer Financing

Start-Up Trucker financing for Owner Operators. All Credit Situations. Bad Credit, Poor Credit, Weak Credits. Aggressively seeking Dealers and Start-Up Trucking Companies.

How To Easily Get Truck And Trailer Financing

Loans to get a commercial truck and trailer are different than a typical auto loan to get a personal vehicle; your local bank won't offer them. Even banks that market their services to small companies typically refuse to finance trucking businesses -- trucking has a notoriously large failure rate for new businesses, and banks don't... Continue Reading →

Bitcoin Facts

Bitcoin continues to be in its first years and it's been hailed mainly as the first reliable digital currency, and it is at heart a uniquely safe database, with a subtle mixture of cryptography and social engineering that makes the center network essentially unshakable, even though hackers in the past disestablished special its exchanges.

South Korea introduces new cryptocurrency rules

The South Korean government on Thursday said that it would impose additional measures to regulate speculation in cryptocurrency trading in the country.

Korean Government Has Doubled Down on Crypto Elimination

South Korea has doubled on its commitment to eliminate using cryptocurrency in illicit activities while expressing a will to foster the country's blockchain development. In a video published Wednesday, Hong Nam-ki, head of the workplace for policy coordination, said the government is taking a strong position in bringing transparency to national cryptocurrency exchanges. You can... Continue Reading →